U.S. Senator speaks on lowering student loan debt

September 26, 2014

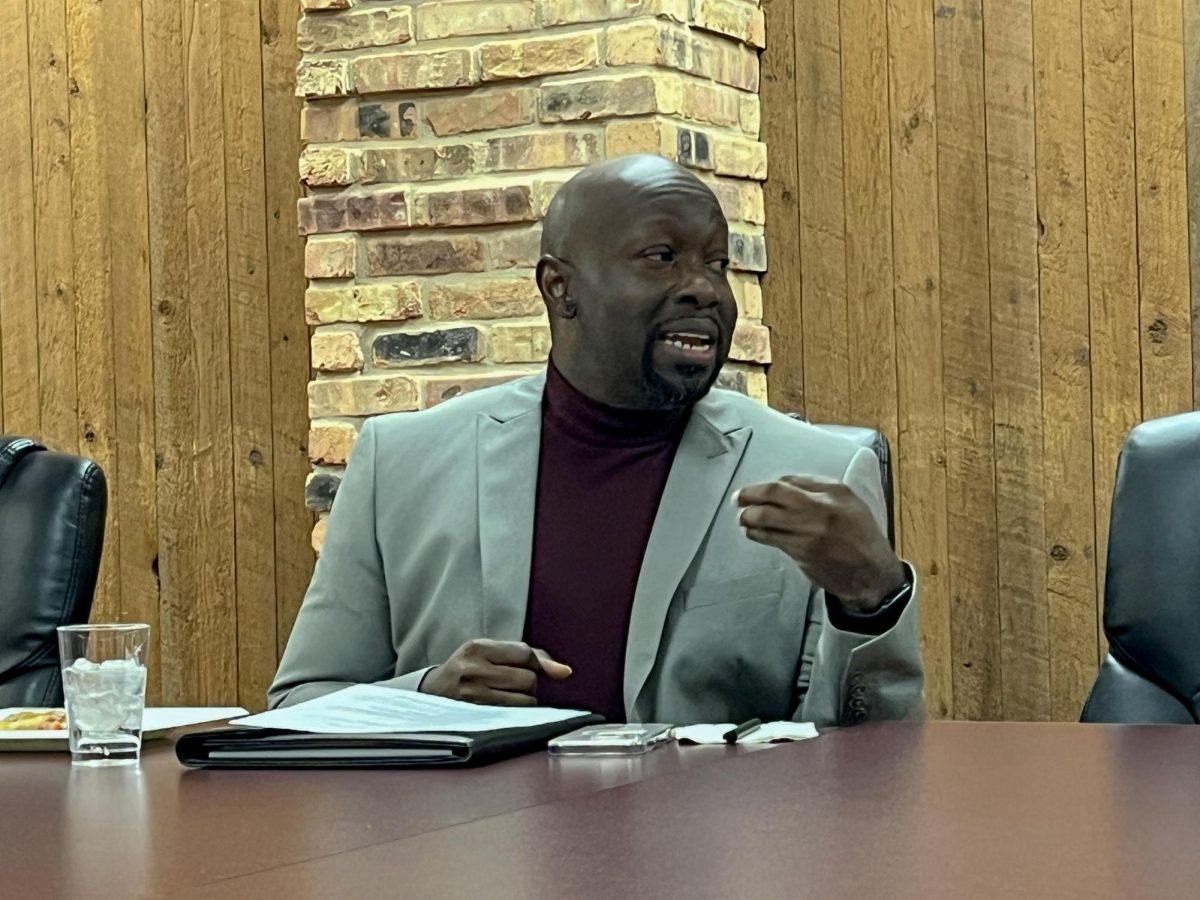

U.S. Sen. Dick Durbin (D-IL) spoke Thursday about student loans and how a new proposed bill could help minimize debt.

Durbin said 1.7 million people in Illinois have a collective total of $47 billion in student loan debt.

“Student debt in America today is greater in total than credit card debt,” Durbin said.

According to Durbin’s press release, many borrowers with outstanding student loans have interest rates of nearly 7 percent or higher for undergraduate loans.

Durbin said 86 percent of student loans get their loans from the federal government, while about 14 percent use private loans services.

Carol Waldmann, the associate director of financial aid, said Eastern has good standing in terms of student loans.

“Our average student loan debt for undergraduates is $20,000,” Waldmann said.

She said private loans are only offered to students as a last resort.

Waldmann said interest rates for federal and private loans vary.

“On subsidized and unsubsidized, interest rates right now are 4.66 percent and they go up every year” she said. “Private loans vary based on a student’s credit and are anywhere from 5 to 10 percent.”

President Bill Perry said Eastern has taken initiatives to help reduce costs for students.

“This year we did not raise tuition fees,” Perry said. “The other thing is that our financial aid office works really hard with students on individual bases.”

Three guest Eastern students shared their experience with student loans.

Graduate student Liz Edwards said her situation with student loans has been manageable.

“A lot of times financial experts say your loans should be less than your starting salary, and it was for me,” Edwards said.

Graduate student Jarrod Scherle also shared his experience.

“I currently have about $10,000 in debt, but my monthly payment is very manageable,” Scherle said. “I have friends who have moved back with their parents, some longtime boyfriends or girlfriends they may or may not have put off popping the question because the situation was not manageable.”

Meanwhile, Shelaina Reids, a senior family and consumer sciences major, said she worries about her student loans on both federal direct subsidized and unsubsidized loans.

“My biggest concern is paying them back and balancing my livelihood,” Reids said. “Right now I am about $40,000 in debt; upon graduating it should be about $50,000.”

James Sysko, a business professor, shared his concerns about the lack of information that students and their families have prior to taking a loan.

He said the solution would be to consult students and their families on their obligations to pay back loans and how long it would take them to repay.

“Many people today just want fast money,” Sysko said. “We need to have intelligent students and parents and a system that encourages that fact of sensitivity.”

Durbin said the situation places students in a tough decision-making process.

“It’s a circumstance there where many young people really count on others to give them advice as to what is a sensible decision to make,” he said. “Then they have to make an almost impossible calculation, ‘Is this debt worth that diploma?’”

Durbin said the Bank on Students Emergency Loan Refinancing Act, which he is one of the sponsors of, would be a solution to help students pay their debts.

The act would allow students to pay off their outstanding loans at a lower interest rate.

According to Durbin’s press release, the bill would save the average borrower $2,000.

In addition, the new legislation would allow borrowers with Federal Family Education loans or Direct Loans taken out prior to July 1, 2013 to refinance their loans at 3.8 percent.

The legislation would be paid for with the Buffett Rule, which would limit tax breaks for the wealthy, according to the press release.

Durbin said the proposed bill did not have enough votes to be passed.

“We fell two votes short,” Durbin said. “This is not over yet. We believe we have to get in and make this happen so students can have a lower interest rate.”

Debby Hernandez can be reached at 581-2812 or dhernandez5@eiu.edu.