Tax fraud affects Eastern employees, Charleston residents

April 14, 2015

While many Charleston residents are finalizing their tax returns for Wednesday’s deadline, approximately 40 Eastern employees and 35 Charleston residents are required to refile because of tax fraud.

Lt. Brad Oyer of the Charleston Police Department said the number of reports is unusual for the area.

“It is quite a number of cases,” Oyer said. “There is no doubt in my mind that the spike is brought on by tax time.”

Paul McCann, the interim vice president for business affairs, said Eastern has about the same number of cases, although not finalized.

“We have seen at least that many cases, because not all Eastern employees live in Charleston,” McCann said.

Tax fraud is described as another person stealing one’s identity and using their social security number to file a tax return, according to the Internal Revenue Service’s website.

McCann said a person who commits tax fraud needs two main pieces of information.

“They have to have access to a social security number and a name,” he said.

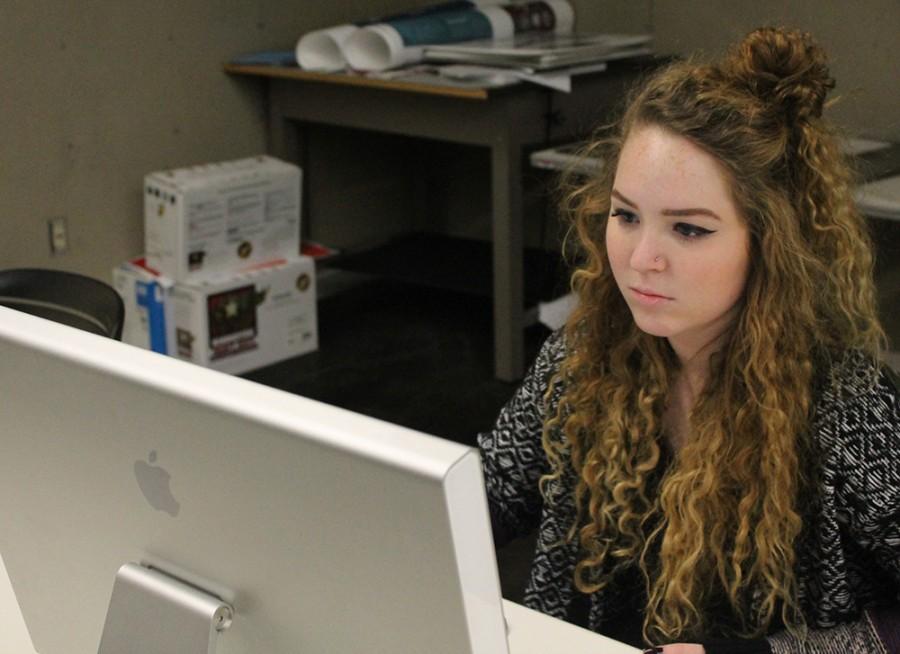

Melinda Mueller, a political science professor, said her tax forms were rejected after filing electronically on April 7.

“Within half an hour of filing, we were sent an email that the IRS rejected it,” she said. “Someone had already filed under my name.”

Mueller said the fraud brought on additional phone calls and paperwork.

“We panicked,” she said. “It took an entire afternoon of phone calls to get everything situated.”

Oyer said someone who has experienced identity fraud should report the file to a local police department, file with the Attorney General and then file with the IRS.

“The process does not start until they kick it off with us with a police report,” he said.

Instead of submitting electronically, Mueller was required to file through the mail and write an affidavit, which is an official document validating her identity.

Oyer said tax fraud can delay a person’s tax return for an extended length of time.

“In reality, it can take a while, a few months,” he said. “If you have a sizable return, that makes a difference.”

Mueller said she did not know of any way she could have prevented her information from being stolen.

“I don’t know what I could’ve done to prevent this,” she said. “It’s different from credit card information. We give our social security numbers to just a very small number of institutions, like our employer, and then you hope that the information is secure.”

President Bill Perry issued a statement Friday that the university has no reason to believe there was an information breach.

“We have found no indication there was a release of information,” McCann said. “We continue to diligently search, and from our source of information, we are unable to find any consistencies.”

Oyer said safeguarding information is the best way to avoid identity fraud, as well as being perceptive and aware of whom the information is given to.

“Charleston has seen scams where people call and pretend to be from the IRS,” he said. “ You need to know who you’re talking to on the phone.”

Oyer said although a number of cases have occurred in Charleston, he believes cases can be found throughout the country.

“We live in the Charleston community, so this the community we see,” he said. “This is much larger than our community, and it is going on in other communities.”

Mueller successfully sent a tax return Monday.

She has been given an additional PIN from the IRS, which will be used as extra security for future returns.

“If this is all that comes of it, this huge nuisance, I will survive, and hopefully it won’t be anything more,” she said.

Megan Ivey can be reached at 581-2812 or [email protected].