AAA State Track and Field Finals

If you need to buy a credit report, there are many websites out there to choose from, but you must be careful; not all of them are effective or even legitimate businesses.

Over the last decade, consumers have become much more aware of the importance of their credit scores, and they buy credit reports regularly to stay on top of their creditworthiness. Buying a credit report is a very good idea, because you can see listings of your credit activity and who has viewed your report recently. You can even use it as a tool to manage your finances.

That said, you should take into account a variety of factors before you buy. Here are six things you need to know before you purchase a credit report:

1. Know what type of information is on it.

Your credit report contains information about all your credit accounts, including credit cards, merchant-issued cards and the balances on each of them. It also lists any loans you may have, such as car loans, home equity loans, mortgages, etc. Your report also displays your record of payment on each credit line and whether creditors have had to take any action against you for unpaid bills.

2. Know how to address errors.

Once you buy a credit report, look for and be prepared to address any errors that can negatively affect your credit score. Errors are more common than you think. If you find one or more errors, contact the specific credit reporting agency right away. The agency will investigate the error. If it’s a mistake, they’ll remove it from your credit report. At your request, they’ll also send a corrected copy to anyone you specify who has received your credit report in the previous six months and/or any employer(s) who may have received it in the previous two years.

3. Know who else can view your credit report.

People and agencies who can request and view copies of your credit report include anyone who has granted you (or is thinking about granting you) credit, prospective employers, companies that write insurance policies, government agencies and others. In short, anyone who has a “legitimate business need” can request and obtain a copy.

4. Know that not all websites that allow you to buy credit reports are the same.

Legitimate websites that allow you to buy a credit report and help manage your credit are plentiful. However, there are also sites set up solely for the purpose of identity theft, so be sure to do business only with those that are VeriSign Secured and have other consumer safeguards in place.

5. Know how long financial information stays on your credit report.

Whether it’s good or bad, credit information generally stays on your credit report for seven years, except for bankruptcies. A bankruptcy stays on your credit report for 10 years.

6. Know that credit reports, by themselves, don’t include credit scores.

Lenders and other credit providers use credit reports and credit scores to measure your risk of defaulting on a line of credit. Credit scores offer credit providers a quick, three-digit evaluation of the information in your credit report, and your scores change whenever new information is entered into your credit files. However, credit scores aren’t part of the package when you purchase a credit report. In most cases, you have to pay extra to view your credit scores, although some programs, including FreeScore.com offer unlimited access to all three credit scores when you join the program.

Buying a credit report is a small expense, but the information you gain from viewing it is anything but trivial. It’s recommended that you purchase one on a regular basis (or visit AnnualCreditReport.com to receive a free credit report from each credit bureau once a year). Credit monitoring will help you stay on top of any errors that appear so you can address them before they hurt your credit. It’s also a very useful tool for seeing who’s requested a copy of your report and for spotting evidence of identity theft. Just make sure you buy a credit report from a legitimate business that helps people manage their credit.

Courtesy of ARAcontent

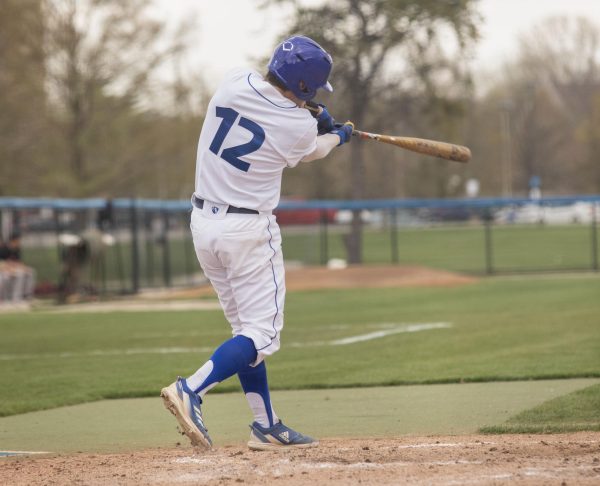

AAA State Track and Field Finals

Runners exchange the batton for the second prelimenary heat of the AAA State Track and Field Finals. (Harrison Bueno / The Daily Eastern News)